A Kiosk on Every Corner

In a quiet village, beneath the rustle of leaves and clinking of tea glasses, a revolution is quietly brewing. Not of slogans or sirens—but of insurance policies, savings accounts, and retirement plans. The schoolteacher no longer needs to travel miles to a bank, and a chaiwallah can plan for retirement while still brewing tea.

This is the new face of financial inclusion in India—driven by trust, kiosks, and local heroes.

Discover how life-changing grassroots initiatives spearheaded by AISECT’s 7800+ rural kiosks are in this blog. These kiosks are more than just service centers—they are lifelines, helping people by enrolling them in government schemes like PMJDY, APY, PMSBY, and PMJJBY.

Stay tuned to find out how the perseverance of local government, initiatives of financial inclusion, and university sports plans are working together to bridge the last mile of banking and provide financial support to all Indians.

Meet the Schemes: Your New Financial Sidekicks

APY is similar to providing a golden umbrella to every individual to shield them from the old-age rains. It enables those employed in the unorganized sector—imagine daily wage workers and small business owners—to make a small monthly payment to obtain a pension when they turn sixty. Nearly 90 lakh new members joined APY during the six-month term courtesy of AISECT kiosks, raising prospects for a stable retirement when grandchildren aren’t knocking on doors for pocket money.

PMJJBY and PMSBY: The safety net twins

The twin insurance plans, PMJJBY and PMSBY, which stand for “life insurance” and “accident cover,” respectively, issued a warning that finally did not go unheeded. With a total of over 75 crore enrolled, the people who had been afraid that one accident would leave them destitute are now protected, knowing that aid is only a claim form away in the event of a crisis.

Trust and Local flair: The Human Factor

That magic, however, does not occur in a dusty emptiness. Local business owners operating AISECT kiosks add genuine warmth and trust to the event. Recalling how he described a RuPay debit card to a dubious flower vendor, one Madhya Pradesh kiosk operator glows with delight, saying, “It’s like your garland of marigolds—except this one grows money instead of fragrance.” She chuckled, registered three neighbours, and completed thousands of rupees’ worth of transactions in a matter of weeks. That’s the mix of local flavor and technology that AISECT is famous for. These kiosks made accessible banking services a part of the daily lives of the local people.

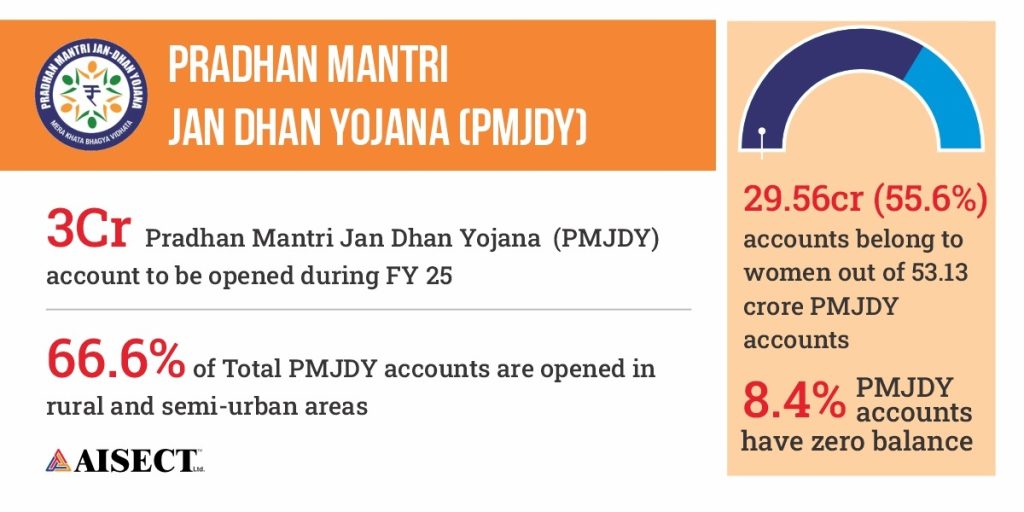

PMJDY: Zero-Balance, Infinite Possibilities

The most well-known of them all, PMJDY, opened zero-balance accounts for more than 1 crore villagers during this time, bringing its total to more than 54.6 crore. The accounts included a RuPay debit card, free coverage from overdrafts, and the ability to take out small loans—equipment that turned recipients of government handouts into active participants in the financial system. When a retired farmer from Odisha used his RuPay card to get his first pension payout, he smiled. “This little card,” he stated, “is a VIP pass to this bank I never knew.”

With AISECT’s kiosks acting in for branches that were out of reach, the rural banks—CRGB, Indian Bank, and UGB—were supporting actors that made reach possible. Through UGB’s cooperation, digital banking was now available in high-elevation communities in Uttarakhand, where highways gave way to difficult paths. The CRGB relationship saw people in Chhattisgarh get microloans and pay their expenses without having to go far. “We believed that banks could only be found in urban areas,” a villager said. “Now, this kiosk is part of our daily routine—like buying chai.”

Beyond the Ledger: Stories of Impact

Furthermore, it involved more than just insurance and account openings. In addition, AISECT kiosks served as digital literacy community classes. In cooperation with state governments like Andhra Pradesh, the kiosks conducted “financial inclusion saturation campaigns” from July to September 2024. They made tech-phobics feel comfortable using mobile banking by teaching the villagers how to use UPI and cautioned them about phishing. “Now I can deposit money for my grandson for his tuition even before finishing my morning chores!” said a Telangana grandma who had attended a session. Only a portion of the narrative is revealed by the numbers: as of January 2025, APY had enrolled its 7.33 croreth pensioner, PMJJBY had 23.6 crore subscribers, and PMSBY had 51 crore. A total of over ₹20,000 crore was paid in claims, which is indicative of the extremely low premiums that enable such a great deal of peace of mind.

The real power, however, lies in stories: the young Bihari mother who was able to cover her child’s emergency medical bills, the autorickshaw driver in Kolkata who eventually opened a savings account for his daughter’s wedding, and the elderly couple from Assam who received their first pension through direct bank credit.

Behind the scenes, AISECT kiosk banking staff handled loan applications and books during the day and transformed into motivational counselors at night to inspire the locals to have big dreams. One attendant laughed about how a young villager used a small loan to buy a sewing machine and start his own tailoring shop. “I told him,” the attendant scolded in mock seriousness, “‘Don’t just mend clothes—mend your future.’ He did, and business is booming.”

The Road Ahead

What are the takeaways from AISECT’s six-month sprint? First, accessibility must be local. The branch miles away is not sufficient; the kiosk on Main Street is. Second, technology needs human touch. Villagers like known faces who speak their language. Third, education is critical. Opening an account with ease and using it wisely needs guidance. Lastly, partnerships increase reach.

By forming a partnership with regional banks and the state government, AISECT made a broad sweep to catch those on the periphery. In the coming times, AISECT hopes to expand even further—microinsurance, credit-linked subsidy programs, and crop insurance are on the services list. They’ll be certifying kiosk operators as community financial counselors with improved relationships and capabilities. And as digital infrastructure matures, they’ll bring mobile-based kiosks to seasonal or forest populations—financial inclusion to those who migrate seasonally. Seasonal or forest populations will have access to mobile-based kiosks as digital infrastructure develops, providing financial inclusion for persons who relocate during certain seasons.

Small Kiosks, Big Dreams

Finally, financial inclusion is the spark that fires economic hopes and safeguards futures; it is not something to be checked off a policy matrix. These financial inclusion schemes in India act as safety nets for millions. The ability of government programs combined with local businesses and some wit to change lives has been demonstrated by AISECT’s kiosks.

From August 2024 to January 2025, they demonstrated how financial services can flourish even in the most remote areas—all it takes is human inventiveness, a smartphone, and the courage to say, “Yes, you qualify for a bank account too.” Kiosk financial inclusion isn’t just about banking—it’s about dignity.

So, keep in mind the kiosk beneath the banyan tree, the village sarpanch punching UPI on his phone, and the cheerful operator at the center of it all when you read headlines about financial inclusion programs. Since genuine change occurs on Main Street, transactional smile by transactional smile, rather than on the boards of directors.